“Consider finishing school and knowing how to solve sophisticated mathematical

problems, recite Shakespeare’s works, or identify every organ in the human anatomy, yet

being clueless on how to use a budgeting app, interpret a bank statement, or appreciate

the implications of accruing credit card debt. This is the quiet fracture in the education

system – a fracture that leaves countless young Indians stranded in the aggressively

demanding real world. In a world where everything from digital payments to taking loans

is just a click away, the status quo of not teaching financial literacy in schools is beyond

obsolete – it is outright perilous.”

FINANCIAL

LITERACY

IS A SKILL,

NOT A GIFT.

– SUZE ORMAN

“The Hidden Crisis: Why

Financial Education in

Schools are a Must-Have”

Financial literacy holds crucial importance in life’s details, such as purchasing a house or

strategizing for retirement. It is frequently observed that students graduate without necessarily lacking the skills that will be inevitably needed down the road. Preparing

students for the professional world is critical, prioritizing crucial elements such as

budgeting and saving, and making essential and educated financial decisions.

Financial literacy gaps originate in school. Science, Math, and History are prioritized

heavily, while understanding how to utilize a salary, comprehend a credit, or strategize for

the future are sidelined. This absence does not stand alone. According to a report by the

National Centre for Financial Education (NCFE), 76% of Indians are considered financially

illiterate, putting students at a dire disadvantage as they enter the workforce. Without

understanding how simple taxes, personal finance, and debt work, these issues create

reckless adults undereducated on investments, taxes, and basic life skills.

But What If This Changed?

Consider the impact of making financial education a mandatory subject in all schools.

Financial literacy taught at an early age motivates students to make informed decisions

and prepares them to navigate the sophisticated financial world efficiently.

The advantages of including financial literacy in school syllabi are limitless:

● Enhanced Self-Confidence: With adequate literacy, students graduate into

adulthood with the capability to manage money effectively by saving, investing, and

spending, ultimately boosting self-confidence.

● Reduced Debt and Financial Stress: Understanding budgeting, loans, and interest

Rates help alleviate the likelihood of students falling into expensive debt traps,

thereby reducing stress in the long run.

● Creation of Future Financiers: Financial literacy empowers students aspiring to

begin their businesses. Students who grasp the fundamentals of income,

expenditure, and financial forecasting stand a higher chance of making it big in

business.

● Economic Impact: With sound decisions, financially literate individuals build

wealth, contribute to the economy, and diminish government dependence through

welfare programs.

“Where Does India

Stand? The State of

Financial Literacy in

Schools”

● Unfortunately, personal finance topics like financial literacy remain rudimentary in

Indian schools. Lack of personal finance education at the institutional level is

prevalent among state board schools, especially. Students are made to

understand the concept of compound interest, but they do not often relate

it to real-life scenarios involving credit card bills or loans.

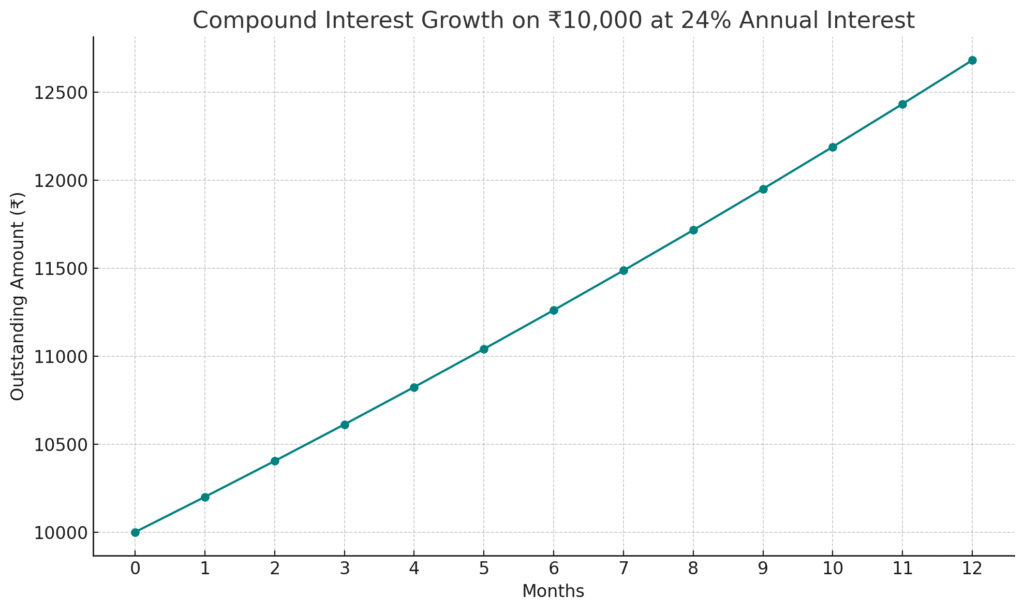

Compound interest means you pay interest not just on the principal, but also on

the interest that has already been added. It’s a snowball effect— the longer you

wait to repay, the more your total dues grow.

📌 Formula:

● A = Total amount due

● P = Principal (initial amount borrowed)

● r = Annual interest rate

● n = Number of times interest is compounded per year

● t = Time (in years)

💳 Credit Card Example:

Let’s say you have a ₹10,000 balance on a credit card with a 24% annual interest

rate. That’s 2% monthly.

If you don’t pay off the balance, interest compounds monthly. After 12 months of

no payment:

● Your balance grows to ₹12,682.50

● That’s an extra ₹2,682.50 just in interest.

📈 What the Graph Shows:

● Each point represents the balance at the end of a month.

● The curve rises faster over time — that’s compound interest in action.

● The longer you wait, the more sharply the debt grows.

✅ Takeaway:

Understanding compound interest isn’t just academic — it helps you make better

real-life decisions. Paying even the minimum due on time or reducing balances

early can break the debt cycle and save thousands.

● Starting in 2022, the CBSE launched a new financial literacy syllabus for classes 6

to 10, which includes topics on digital banking, UPI, and money management. Most

schools did not adopt it, but NPCI supported it.

● Despite gaps in implementations, the NEP 2020 advocates for finance and digital

skills education at a foundational level. Schools have started offering workshops in

urban areas, but government and rural schools are yet to catch up due to a lack of

trained educators and overall resources.

● All students need to be financially educated in a practical manner that does not

discriminate against various regions or other types of secondary schools.

Designated educators are widely accepted to be trained in related subject areas, so

materials need to be available everywhere without hesitation or inconvenience.

Challenges in

Implementing Financial

Education in Schools

In a country like India, implementing financial literacy within the academic framework

poses unique hurdles despite its benefits.

● Inadequate Instructor Training

Incorporating personal finance education into the curriculum is not feasible because

most instructors do not have training in the subject area. This knowledge gap inhibits

their ability to teach financial concepts appropriately, resulting in half-baked teaching

devoid of any practical value. Students, upon graduation, are equipped with scant

relevant knowledge and skills.

● 📘 Content Restructuring Challenges

The existing school content already exceeds the available time for students while leaving

little to no room for adding new concepts. Financial literacy is often neglected because it

is not a core academic subject, but a primary life skill needed during the adult phase. To

be taught effectively, it requires thorough refinement, accompanied by curriculum

changes and educational board approval.

● 🌐 Rural Educational Inequities

The use of modern aids like digital and mobile banking finance tools poses a pitiful

educational discrepancy for students residing in underfunded schools, particularly those

situated in rural areas. Insufficient access to the internet and smart devices, as well as a

lack of virtual literacy programs and resources, contribute to the widening gap in

educational opportunities.

● 🚧 Bridging the Gap

India must improve access to teacher training, curriculum adaptability, and digital

resources to turn “financial literacy for students” into something beyond mere words.

Only then can it become a habit for every schoolchild across India.

The Rise of Digital

Financial Literacy in

Schools

In the fast-digitizing world, finance isn’t just about having a piggy bank anymore since it

involves mobile apps, UPI, and e-wallets. As schools recognize the importance of

adapting to modern technologies, students are exposed to new forms of mobile finance.

● The Elder Generation: A Shift from Cash to Clicks

Real-time transactions, budgeting, spending, and savings are being tracked through

mobile apps, and personal finance is becoming easier and more interactive for elders.

Now, assisting kids with pocket money is a whole new experience, as it is being paid

through UPI.

For instance:

Mobile banking apps assist students in tracking their expenditures and savings through

balances that gauge their limits and prevent overspending.

Paytm and PhonePe, like digital wallets, make payment systems easier for students.

Fun through gamified learning and apps makes learning about interests, saving goals, and

transaction history engaging and easy to comprehend.

● 🏫 Programs Initiating Education on Digital Financial Literacy

RBI’s Financial Literacy Week, SBI’s YONO for Youth, and many other NGO-sponsored initiatives seek to teach digital payments through workshops, videos, and simulations in

Schools. These initiatives focus on creating awareness about the following:

❖ Carrying out transactions online in a safe manner

❖ Understanding various digital payment systems

❖ Fraud and cybersecurity prevention

● 🤝 CBSE & NPCI: Paving The Future Together

A notable development came in 2022 with the Central Board of Secondary Education’s

collaboration with the National Payments Corporation of India (NPCI) to develop and

Implement a financial literacy course for grades 6 to 10. It includes:

● Introduction to digital banking and UPI

❖ Cybersecurity components in financial transactions

❖ Social responsibility in the use of payment systems

❖ While the initiative is still in its early stages, this is an encouraging sign toward

establishing digital financial literacy as a standard in school curricula.

How Schools and

Parents Can Foster

Financial Awareness

Teaching kids the value of money can’t be left purely to textbooks. It’s a collaborative

responsibility between the school and parents. Both can foster money-wise and

responsible citizens who know how to earn, spend, save, and invest.

● 🧠 Tips for Integrating Financial Literacy into Daily Learning

Use Real-Life Scenarios: Teachers can have students participate in budgeting exercises,

run mock shops, or participate in monthly saving contests.

Math with a Purpose: While teaching interest, percentages, or ratios, make connections

to bank interest, EMI payments, or discounts.

Classroom Savings Accounts or Points: Create a classroom economy using virtual “class

currency” to incentivize saving, spending, and resource management.

Role-Play Activities: Let students be buyers, bankers, business owners, and other roles

During business simulations.

Project-Based Learning: Challenge students to construct a detailed “plan a ₹5000

monthly budget” or “analyze mobile data plans” project.

● 🛠 Free Tools and Resources to Use

Both schools and families can utilize these provided resources:

❖ 💡 Reserve Bank of India’s Money Kumar Series

The Reserve Bank of India created this comic-style series to teach children banking

concepts in a fun and engaging way through amusing stories about a character named

Money Kumar. rbi.org.in

❖ 📘 NCFE Financial Literacy Modules

The National Centre for Financial Education NCFE offers relevant online learning modules

for students of different ages and grade levels. https:/ ncfe.org.in/

❖ 📱 RBI’s Financial Education App

An interactive mobile application containing games, quizzes, and videos designed for

children.

❖ 📺 YouTube Channels

“Smart Money with Chhotu” or RBI’s Financial Awareness has great content that teaches

essential concepts in a fun, bite-sized manner.

● Teachers and Parents’ Responsibilities

Teachers

❖ Teach finance as a practical life skill, not a theoretical subject.

For Example:

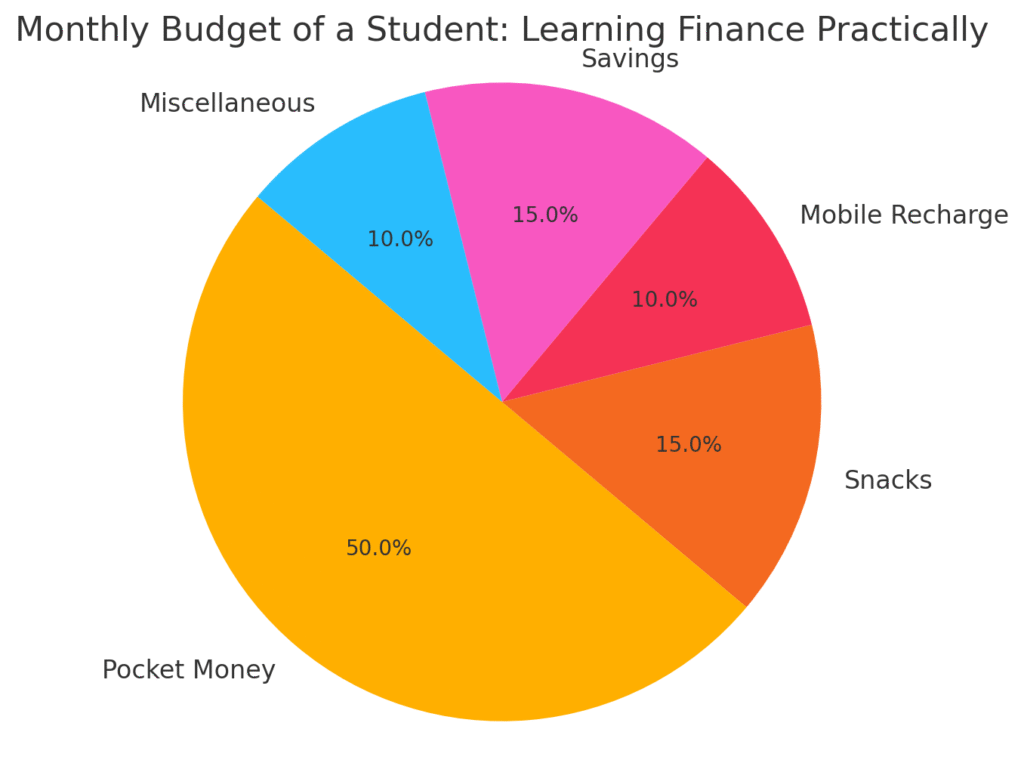

Here’s a simple way to introduce finance as a life skill using a real-life example:

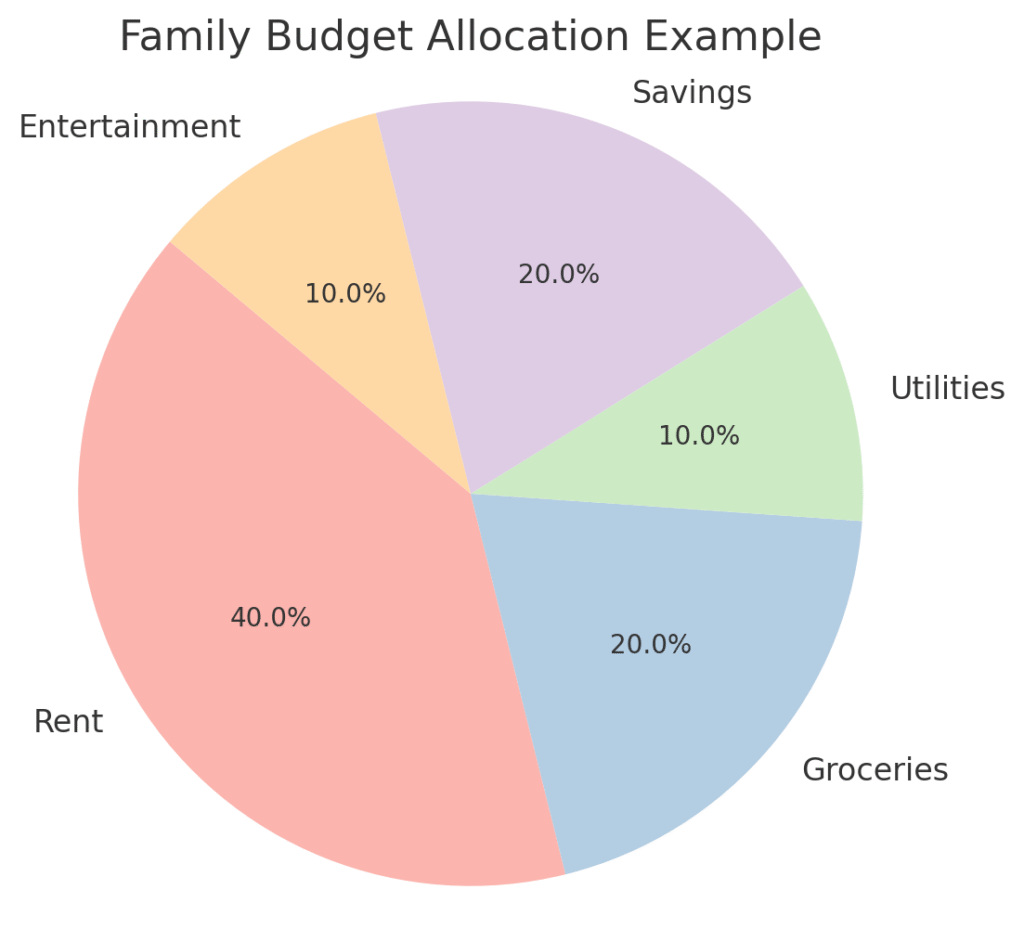

Instead of just teaching formulas, let students manage a mock budget. For example, a

student receives ₹1000 monthly. They allocate it to snacks, mobile recharges, savings,

and other needs. This teaches budgeting, planning, and financial choices—skills they’ll

use for life.

The pie chart above shows how a student might divide their monthly allowance, helping

them visualize where their money goes and how much they can save.

❖ Participate in professional training to become more financially literate.

For Example:

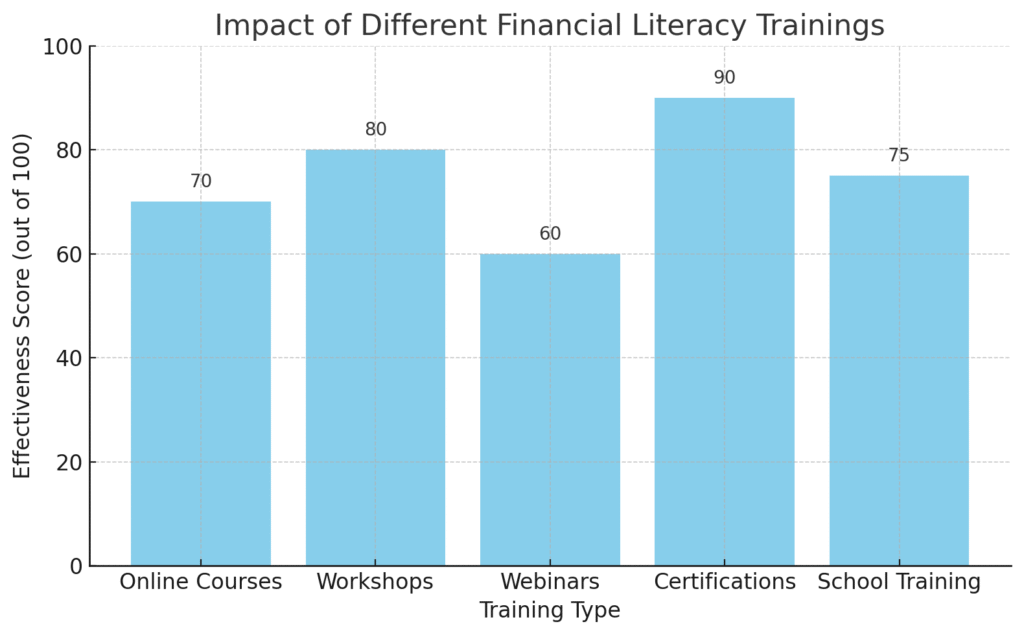

Participating in professional training, such as certifications, webinars, workshops, and

School programs significantly boost financial literacy.

The graph above shows the effectiveness of different training types, with certifications

and in-person workshops being the most impactful. These trainings help students and

educators make smarter financial decisions, understand investments, loans, and savings,

and apply these lessons confidently.

❖ Promote frank dialogues concerning money, spending, saving, and budgeting

🏠 Budget Talk Made Simple

At home:

We have ₹30,000 this month. Should we spend more on food or save for a vacation?”

At school:

Students role-play planning a family budget — deciding how much to allocate to rent,

food, savings, and fun.

The pie chart above shows a simple family budget, which is a great way to help kids

understand priorities in real life.

Parents

❖ Take your children’s opinions concerning money, such as shopping and online

purchases.

❖ Please provide them with allowances to learn how to budget.

❖ Utilise available financial goal-tracking applications, such as “saving towards a new

toy” or “family dinner budget.”

● 🌱 Closing Remark

A child’s relationship with finances can be nurtured at any time, from lunch discussions

to class activities. With the collaboration of homes and schools, financial literacy can be

cultivated as a habit instead of being treated purely as a subject.

Real Voices, Real

Rupees: Financial

Literacy in Action

📘 1. Aarav’s First Savings – A Student’s Story from Urban School, Delhi

“I never saved any money because I spent all my pocket money on snacks. After a math

class where a budgeting game was played, I started saving ₹100 a month. In six months, I

was able to buy my own headphones without asking my parents!!”

– Aarav, Class 8, CBSE School.

Why it matters: Understanding the impact of small savings and how to turn a theory into

reality has assured Aarav.

2. Professional Experience: Teaching Finance with Real-Life Assignments

“As part of my Diwali lesson plan for the year 8 class, I gave them a ₹2000 budget to plan

all gifts, sweets, and decor that will be purchased for Diwali. Not only were they solving a

mathematical problem, but they were also considering price comparisons, need vs want

prioritization, and willful entertaining debates.”

– Revathi Menon, Social Science Teacher, Chennai.

Why it matters: Such works develop useful lifelong skills that will continue to aid beyond

the classroom and not only grades.

🌾 3. Rural vs Urban Gaps – A Tale From Two Schools

Students in a rural school located in Bihar had never been exposed to digital wallets.

However, students in an urban Bengaluru school were being taught UPI and even

discussing the basics of crypto. The gap is not only limited to the curriculum; it goes

beyond access and exposure.

These stories give further insight into the critical lack of equity in the access provided for

financial education.

🧾 Conclusion: From

Awareness to Action

Financial literacy is more than a topic in a curriculum; it is a life skill one needs to

survive. As India moves towards a digital economy, educating children on responsible

money management is not optional anymore: it is a necessity.

The gap between urban students learning to save in schools through games and rural students

schools, eager to engage with finance, waiting for basic access, is telling: financial

Education is a priority that needs immediate, collective national action. Where schools

and parents work together with policymakers, students will be empowered to not just

count money, but to make it count.

Let us not wait for students to stumble in adulthood—rather,er let’s prepare them for the

world from the classroom.